Why are we waiting?

You’ve done the work or sold your product and issued your invoice, now you’re waiting…and waiting…and… waiting some more to get paid.

Chasing Debtors is never a fun job, but there are a number of small things you can do to encourage your clients and customers to pay you much earlier, reducing the need for you to go chasing them.

Get consistent with when you send invoices & statements.

If you are inconsistent with when you send out your invoices, it sends a subconscious message that it’s not high on your priority list, and if it’s not high on your priority list why should it be high on your customers?

It also makes it much harder to implement other stages of your debtor management procedures if your invoicing is sent out late.

In the not too distant past I too was less than consistent with issuing my own invoices. Once I scheduled it into my diary and made it a priority every month, over time my clients also became much more consistent with their payments.

Make it clear what you are charging for.

If your invoice is vague and unclear then it’s likely to end up in a pile to deal with or query later.

You want to include enough information in your invoice so that your customer knows instantly what the bill is for and what was included (especially important if it is a part charge or interim bill).

However you need to keep it concise, if you go into every last little detail the important details get lost, the invoice gets confusing and ends up on the deal with or query later pile.

Get your invoices and statements delivered instantly.

Do you still print your invoices and post them in the snail mail? Not only is the cost of postage sky rocketing, in the not too distant future snail mail will likely only be delivered three days per week and the time spent printing, folding and stuffing envelopes is better spent elsewhere.

These days good accounting software can get your invoices and statements into your customers hands/ inbox within seconds of pushing a button. Some accounting software such as Xero can also generate online invoices with links enabling your customer to pay you then and there. You can read more about this here.

Make it as easy as possible for your customers to pay you.

Include details of how your customers can pay you, your bank account details should appear on your invoices and statements.

Electronic banking is constantly changing. These days you can get paid via credit card using mobile apps and technology that effectively turns your mobile device into an eftpos terminal. PayPal is also a great option for many.

Have clear payment terms.

Decide on your terms of service, when you will invoice, when you expect to be paid, what happens if these terms aren’t met.

Make sure your customers are aware of these terms at time of sale, include them on your invoice or statement.

Early payment discounts and late payment penalties.

Both of these can be effective, if you choose an early payment discount then obviously you need to consider the cost of this and build it into your sales margins.

Often a late payment charge can be much easier to maintain. It can also be a great tool for leveraging faster payment of outstanding invoices. You can offer to reverse or reduce the interest charge if the outstanding balance is paid today… within the next week… whatever terms you decide/negotiate.

Follow up.

Engage with your customer, a quick, friendly phone call or email maybe all that’s needed to clear up any queries, misunderstandings or oversights.

If it is agreed that the customer will pay on a certain date, make a note of it and follow up again.

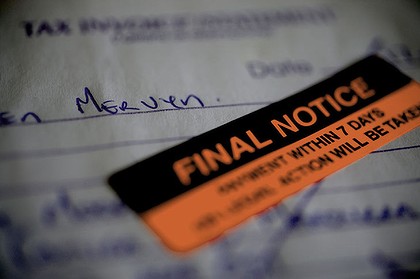

You also need to adjust the tone of your interactions each time you need to follow up on an outstanding invoice.

From time to time there does eventually come a point where you need to put on your big girl/ boy undies and call in the big guns… the debt collectors. When this happens it helps if you have made provision for passing the cost of debt collection to the debtor in your terms of sale. Without this you will be absorbing any debt collection costs yourself.

Often it is a number of small, easily remedied things that can contribute to a much larger debtor management problem.

What are your best tips and tricks for getting your invoices paid on time?